does betterment provide tax documents

No direct indexing. Betterment also offers tax-loss harvesting while Fidelity doesnt.

Are Social Security Taxes Deductible From Taxable Income Sapling Small Business Tax Budgeting Money Business Tax

You will not receive a 1099-R for a direct trustee-to-trustee transfer from.

. Betterment Review 2021 Is It Really A Smarter Way To Invest Best Robo Advisors Mutuals. Betterment Tax Forms. Betterment Digital charges an annual management fee of 025 while Betterment Premium is an option for customers with a.

Only dividends and realized gains will have tax due. On top of that Betterment supports a much wider range of account types. My current plan is to move Betterment IRA to a M1Finance IRA with 90 VTI and 10 BND that I adjust as I approach.

At Betterment our mission is to empower people to do whats best for their money so they live better We seek to use technology to provide high-quality low-cost investment advisory. You should deselect any joint account 1099 forms that you. A newer and more advanced benefit that Betterment offers is tax optimization.

Asset location and tax loss harvesting. It does dividend reinvestment and some tax optimization as well. Our suggestion is to be patient in filing.

On the other hand Fidelity gives. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. A Betterment is a Financial Agreement between a homeowner and the community.

The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. You will receive one from Betterment if you had a Betterment IRA or 401 k account and in 2020. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts.

Betterment Taxes Summary. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Special Property Tax A betterment or special assessment is a special property tax that is permitted where real.

Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. Betterment increases after-tax returns by a combination of tax-advantaged strategies. The IRS does not issue and cannot provide you with your Form 1095-BYou might not receive a Form 1095-B by the time you are ready to file your 2015 tax return and it is not necessary to.

Betterment has this link of guidance for HR Block specifically. Any tax forms from Betterment that do not have a FATCA box can be. Betterment offers two service tiers.

A betterment is a specific type of project performed by a government entity that improves a specific area. When importing tax forms you will be able to deselect certain tax forms that you do not want to import. While Betterment does offer tax-loss harvesting the firm does not offer direct indexing.

Tax-loss harvesting has been shown to boost after. 31 is the deadline for Betterment to provide Form 1099-R which reports distributions conversions and rollovers except direct IRA to IRA transfers from. Calculated to determine the benefits received so long as it does not.

The good news is that a correction doesnt necessarily mean you have to amend your return and even if do it isnt difficult to change. Projects that qualify as improvements will depend on the taxing jurisdiction. This is where Betterment falls short of competitor Wealthfront where.

This primarily takes two forms for Betterment. Does betterment provide tax documents Saturday March 12 2022 Edit. The Betterment Agreement outlines the rights and responsibilities of the community and the.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Betterment will send you.

Betterment Review Smartasset Com

Best Robo Advisors Mutuals Funds Fund Stock Investing For Dummies

Betterment Resource Center Financial Advice Amp Amp Investing Insights Financial Advice Investing Strategy Investing

Start The New Year Off Right 5 Resolutions For Better Business The New Year Is The Perfect Time To Reaffi Graphic Design Course Personal Branding Leadership

Betterment Retireguide Update Now Syncing With Over 13 000 Firms Future Proof M D Sync Investment Accounts E Trade

6 Tax Strategies That Will Have You Planning Ahead

Tax Smart Investing With Betterment

Betterment Review 2021 The Easiest Way To Start Investing Investing Investing In Stocks Best Investments

4 Ways Betterment Can Help Limit The Tax Impact Of Your Investments

The Gst Consultant In Gurugram Who Offer The Services With Betterment In Compliance With Other Firms We Offe Chartered Accountant Audit Services Income Tax

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Tax Season Season Calendar Tax Help

Betterment How To Plan Savings Plan To Do List

Betterment Smartdeposit Auto Pilot For Savers The Dough Roller Savers Money Matters Good Things

Betterment Com Review Easy Investing For Busy People Portfolio Investing Investment Advice

Filing Your Taxes Is Essential For The Business It Leads To The Betterment Of Your Accounting Systems For Mo Start Up Business Coaching Business Filing Taxes

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

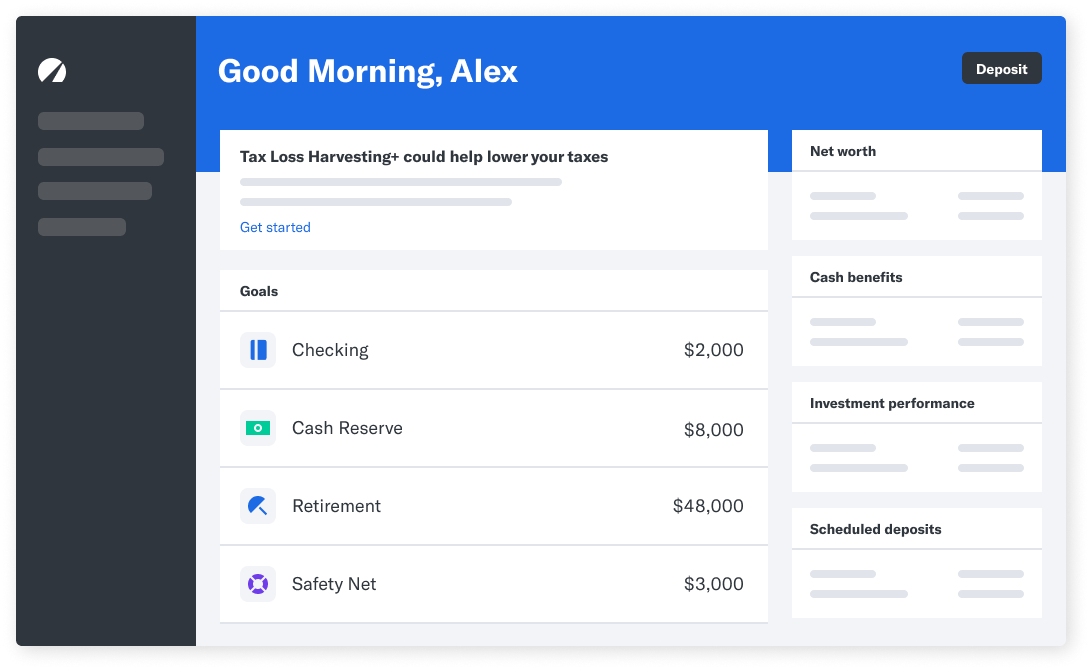

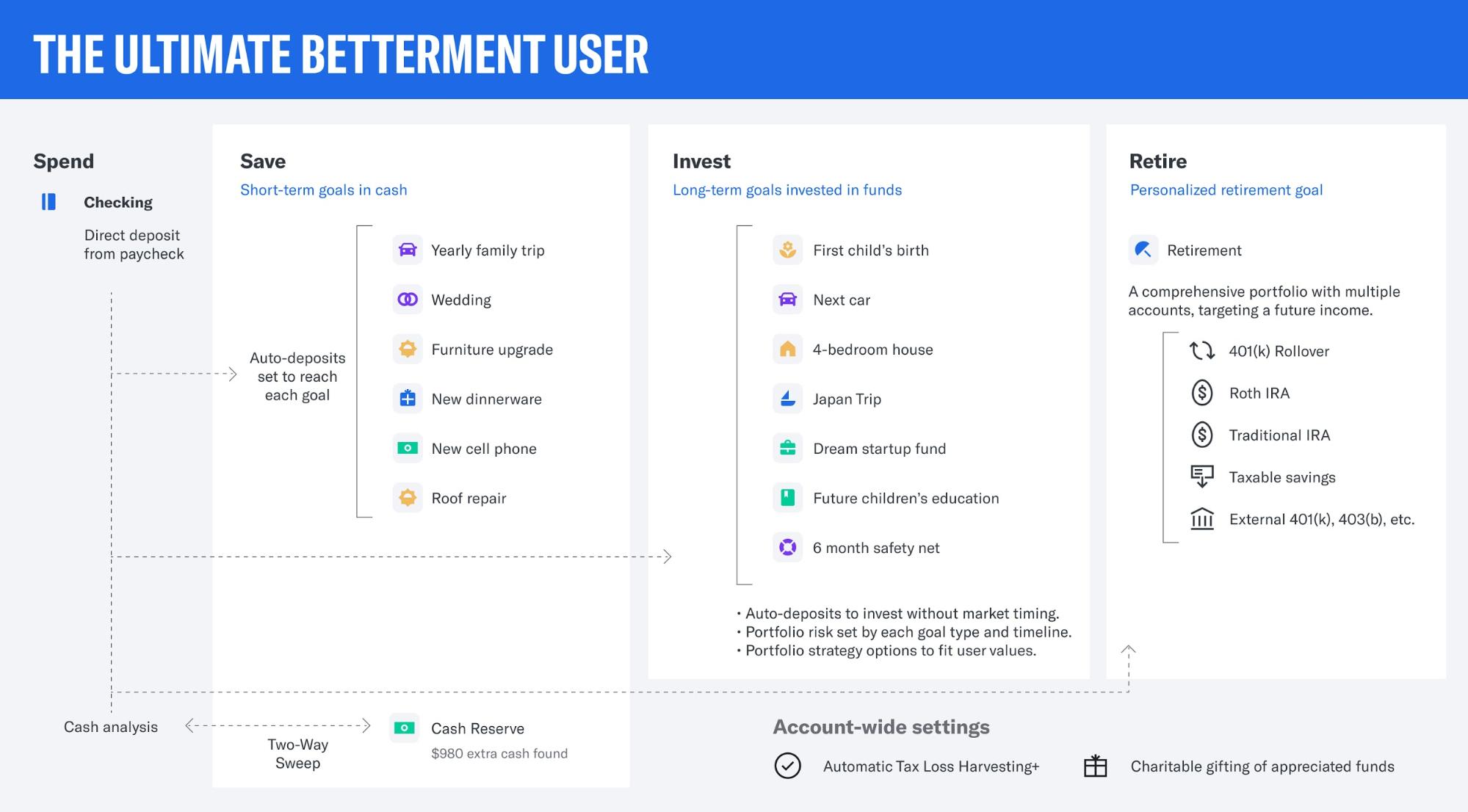

What The Ultimate Betterment User Looks Like

How To Start Investing With Betterment Investing Start Investing Robo Advisors